Jeff Brown Penny IPOs: The 4X Window – Names and Tickers

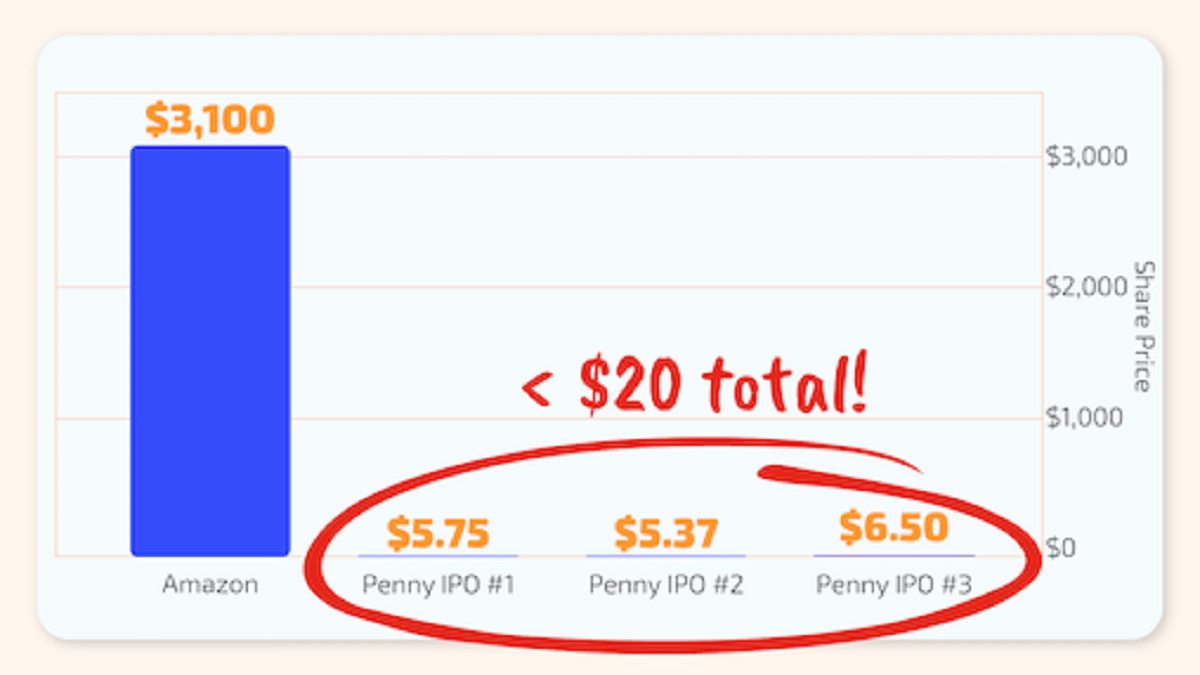

There’s a small subsector of the tech market, a class of stocks Jeff Brown calls “Penny IPOs.” This tiny subsector is coming up on a very special time that he calls the “4X Window.” That’s when we’ll see these explosive stocks go into hyperdrive. To learn more tune in for Jeff Brown Penny IPOs: The 4X Window event….