Contents

Jeff Bishop’s Portfolio Accelerator Review – What is it?

Jeff Bishop teamed up with some of the industry’s brightest minds – Jordan Belfort, Howard Lindzon and Allan Marshall – to reveal how you can take advantage of this market and how he expects to 10X his portfolio over the next 3 years.

You’ll get Jeff’s NEWEST investing manual, never-before seen interviews with this group of industry giants.

Finally, you’ll get a LIVE training session, where Jeff Bishop will reveal his Portfolio Accelerator.

Jeff Bishop’s Strategic Investor Summit – CLAIM YOUR FREE SPOT HERE

Who Is Jeff Bishop?

Jeff Bishop is a professional Trader and Founder of RagingBull.com, which is financial education and trading website dedicated to helping other professionals achieve success in trading. He brings nearly 20 years of professional experience, and has become known as a leader in trading. While Jeff has experience working in nearly every form of trading, he specializes in options trading, something that he teaches to other individuals interested in trading.

Jeff Bishop attended the University of Texas, where he earned a degree in finance, and a degree in economics. Following graduation, Jeff began working before giving up his office job to pursue trading full-time. Soon after becoming a full-time trader, Jeff met Jason Bond and became his mentor as Jason learned about trading and the stock market. They teamed up to create RagingBull.com, or Raging Bull Trading, in 2010.

Today, Jeff Bishop remains as a mentor to countless students through his trading programs. Jeff is passionate about helping other traders find success by teaching his own strategy that he uses in trading. His skill as an entrepreneur has allowed Jeff to implement successful business ideas throughout the years. In addition to his success in professional trading and education, Jeff is also a member of the elite MENSA, which is known as the largest and oldest high IQ society in the world.

In 2019, Jeff and Jason decided to open the RagingBull.com Foundation, which is dedicated to supporting the community by raising money through their trading profits for local charitable organizations.

Jeff Bishop’s Strategic Investor Summit Timetable

Jeff Bishop’s Strategic Investor Summit – CLAIM YOUR FREE SPOT HERE

Jeff Bishop’s Strategic Investor Summit timetable goes as it follows:

FRIDAY APRIL 17TH

The 10x Portfolio Blueprint

SATURDAY APRIL 18TH

Interview with Jordan Belfort, The Wolf of Wall Street

SUNDAY APRIL 19TH

Interview with Howard Lindzon, Co-Founder of StockTwits

MONDAY APRIL 20TH

Interview with Allan Marshall, Founder of XPO Logistics

TUESDAY APRIL 21ST AT 8PM ET

LIVE! JEFF BISHOP’S PORTFOLIO ACCELERATOR

Jeff Bishop’s Strategic Investor Summit – CLAIM YOUR FREE SPOT HERE

Jeff Bishop Trading Services

Jeff Bishop Total Alpha Trading – How it works?

Did you know that the consumer staples sector is outperforming the S&P 500 by 8%?

That’s right! While the SPY sank over 25.5% from its highs, the XLP consumer staples ETF is down less than 17.5%.

I’m talking about the grocery stores, the pharmacies…and all the other places that remain open during this lockdown period.

Heck, some of these stay at home plays have led to some sick profits.

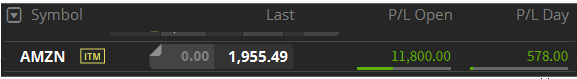

My favorite in the group has been Amazon (AMZN). With so many folks ordering online now, I got some great Total Alpha trades in this stock.

Some of these trades come right out of my masterclass!

Folks, we’re at a critical juncture in the market. I believe some consumer staple stocks are due for a run. But you shouldn’t just throw your money into any old safety play.

In fact, one traditional safety trade is about to get blasted…

And I want to tell you all about it.

Bond buying is unlimited… until it isn’t

A couple of weeks ago the Federal Reserve came out and pledged to back the financial system with zero interest rates and quantitative easing. They saw the problems ahead and decided to flex their muscles.

So, why would they start tapering off their bond buying program? This Thursday, the Fed is expected to cut its purchasing of U.S Treasuries from $75 billion a day to $60 billion per day.

As they navigate uncharted waters, the Fed is trying to figure out the right level of purchases. It wound’t be a surprise if they upon finding that to be too little they resume the pace.

For us, that makes it a trick bond trade. We’ve already seen the TLT rally to historic levels.

TLT Hourly Chart

If the market doesn’t like what it hears, bonds could quickly find themselves selling off along with equities. It makes me skittish about taking any new long bond trades here.

Instead, I’d rather look at the glorious metals market.

Gold and silver make me quiver

We saw what amounts to a massive unwind in the gold and silver markets. These normally sleepy areas woke up crying and crabby.

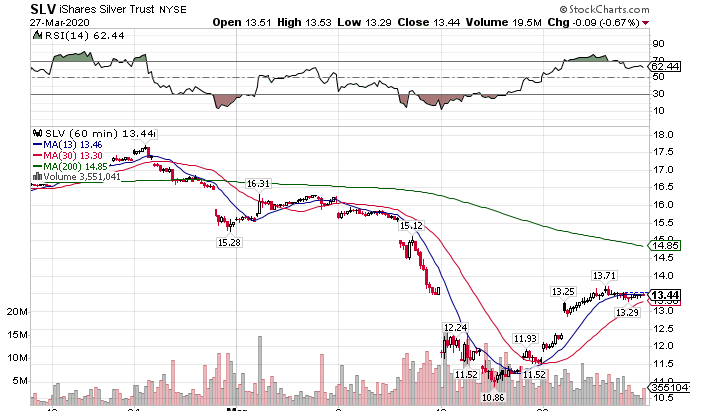

Take a look at the rout we saw in silver just the other week.

SLV Hourly Chart

Long-term, this is a great ETF to hedge your portfolio with. Short-term, it’s a 50/50 whether it gets creamed with the markets again. However, if it dips back down to near $10 again on the SLV, I’ll be stepping in with some trades.

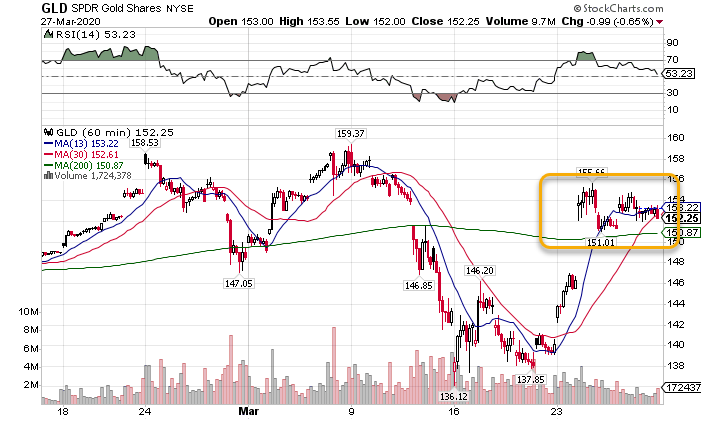

Right now, I like gold as the trade of choice against a falling stock market. I believe we’ve seen enough liquidation in the yellow metal. I like the chart setup here with the bullish consolidation pattern forming.

GLD Hourly Chart

Unlike silver, gold managed to recapture it’s 200-period moving average on the hourly chart. That’s a bullish sign that should lead to higher prices.

However, I want to keep any trades here on a tight leash. Daily closes below the 200-period moving average and I’ll walk.

Stand Clear of Energy

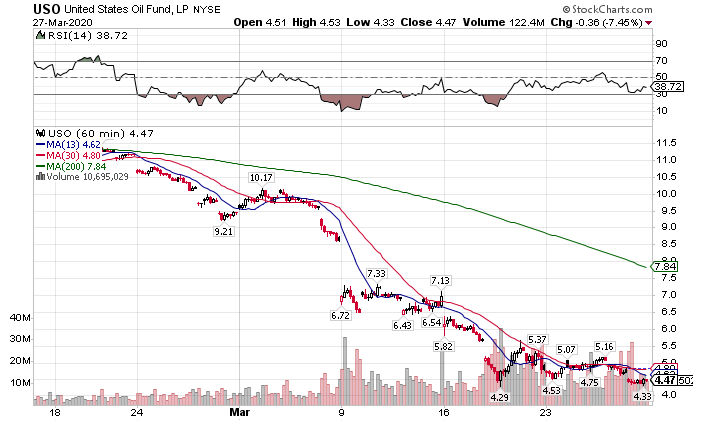

I would have thought the administration would step in and muscle Saudi Arabia into production cuts by now. Instead, more oil is pulled from the ground as demand falls off a cliff. That’s made oil as cheap as it was when I was in college.

This is when you know things are starting to become a problem. Take a look at the USO ETF chart.

USO Hourly Chart

Chances are this ETF will need to do a reverse split. They’re probably not the only ones. I expect we’ll see some of the 3x leveraged ETNs start to go under in the near future.

Just to give you an idea, here’s a quick list of some that are closing up: AMJL, MLPZ, OILD, OILU.

Volatility may be here to stay

Typically, when stocks rise we see volatility contract. That has yet to happen in any meaningful way, even with these record rebounds. In fact, we’ve actually seen the VIX go up alongside equities.

VIX Hourly Chart

Why is this happening? No one believes the rally. Investors and traders are using any rebound to buy protection in the form of options on the S&P 500, and for good reason. Despite the massive stimulus bill, we still have no clarity as to when all this will wind down.

For now, we may be set up to experience one of the longest periods of elevated volatility in history.

This Is How I Identify My Total Alpha Trades

Elevated volatility means that I get paid way more for my option trades than normal. Some of these option contracts are paying me 4% on the stock’s price in a week to sell them.

I don’t know about you, but that is a rich payout.

The best way to take advantage of these trades is to learn how to set up these option trades. There’s no better place to learn these strategies than starting with my free options masterclass. You’ll get immersed in the basics of options and partake in some secrets that I’ve only recently begun to share.

Click here to sign up for Jeff Bishop Total Alpha Trading free options masterclass.

Jeff Bishop Bullseye Trades – How it works?

Gravitational Lines Calculations

Before we get to the fun part and how we can use the gravitational line as a trading tool, we’ll need to see how it’s actually calculated—don’t worry though, you don’t need to do any math whatsoever.

The 200-period moving average refers to the simple moving average. The calculations are pretty straightforward. You take the closing price for the last 200 periods and average them. This creates a point for that period. Connect the dots, and you get the 200-period simple moving average.

You can find them on most stock charting software as a standard indicator. They may be labeled as SMA for simple moving average.

When you pop it into a chart, it will look something like the green line in this SPY chart.

Traders like using the 200-period moving average as a guidepost. It takes a long time to turn around. Shorter time-frame moving averages like the 13-period moving average react quickly to price change. When you get sustained trends, you’ll start to seem them play out on the 200-period moving average over time.

Understanding Trends

The first step to identifying reversal patterns is to figure out the overriding trend. You want to find a setup where the long-term trend remains intact, but the stock makes a retracement within that framework.

Even with the recent pullback, the stock remains in a bullish trend overall.

How can I tell? First, I look to the 200-period moving average on the daily chart. ROKU not only hasn’t hit it since the beginning of 2019 but remains solidly above that indicator. Many traders, not just myself, use the 200-period moving average as a line-in-the-sand for determining trends.

Now, the key is that the stock needs to be trading above the 200-period moving average consistently. Stocks that waffle back and forth, crossing it multiple times, aren’t necessarily bullish.

Overall the stock looks more bullish than bearish. However, I wouldn’t say there is a clear, overriding bull trend here. Nor would I use the gravitational line to trade against. You can see how the stock crosses the line multiple times. This reduces its importance.

On the flip side, the gravitational line can become resistance. Stocks with protracted downtrends will often bounce off the 200-period moving average on spikes.

Selecting Your Time-Frame

The charts I’ve shown you so far are for daily periods. However, the gravitational line really works on any time-frame. The key is to understand how it lands in context to the larger trend.

For example, let’s use the ROKU daily chart from before. We had a clear, uptrend that’s still intact.

Right now, the stock is trading under the 200-period moving average and looks rather bearish. If I want to play short-term, I can be short against the 200-period moving average all the way down to the daily moving average at $114. However, down there, I would expect the longer-term gravitational line to outweigh the short-term one.

Ideally, I want both the long and short term trends to align. However, we don’t always get that lucky. The key is to avoid trading against the longer-term averages using short-term time-frames. Otherwise, you run the risk of the trade reversing in your face.

The Right Amount of Time Since It Touched

I’ll share a little secret with you. Ideally, I want the stock not to have touched the gravitational line for about 25-30 periods of whatever time-frame I’m looking at. The longer it’s been since the touch, the more likely the gravitational line becomes a trade level.

That doesn’t mean it works every time. But trading is about probabilities. Create the right conditions, and you’ll generate more wins than losses.

This Is How I Identify My Bullseye Trades

Many of my Bullseye Trades use this exact method as an entry, a stop out, or a target. These are trades I aim to get a +100% return each week. So with one trade idea for the week, I want to make these the best ones possible.